Resources, investment and borrowing

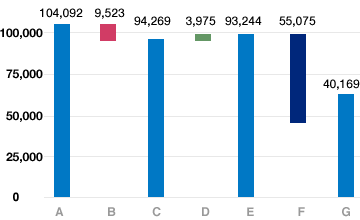

Pre-tax profits, interest, depreciation and amortisation (EBITDA) totalled € 104 million and funds from operations generated operating cash flow of € 98.2 million, a fall of 14% compared to the € 86.3 million the previous year.

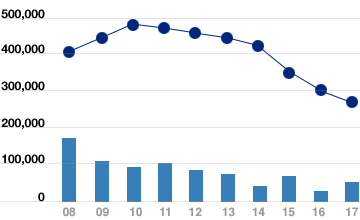

The Port Authority performed investments to the tune of € 58 million, double the figure for 2016, involving a surplus of € 40.2 million compared to resources generated by operations.

It is also worth noting the incorporation of € 22.2 million derived from concessions returned.

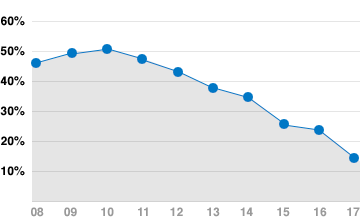

As regards the level and progression of debt, the Port Authority transferred a total of € 22.8 million to short-term, and returned to a stable amortisation rate (some tranches had been cancelled in advance during the previous two years), so that long-term bank borrowing stood at € 281.1 million at the end of the year, the lowest figure of the last 12 years.

Thus, the debt ratio fell to 21%, the lowest figure since 2003, due partly to the effect of progressive reduction in debt volume, and also to the application of profits to the entity’s assets.

EBITDA (thousand EUR)

| 2017 | 2016 | Variation | %Var. | |

|---|---|---|---|---|

| Operating profit | 47,776 | 33,886 | 13,890 | 41% |

| Plus | 69,248 | 73,553 | (4,305) | |

| Funding Puertos del Estado | 5,700 | 5,744 | (44) | |

| Net contribution to the Interport Compensation Fund | 4,123 | 4,035 | 88 | |

| Depreciation of fixed assets | 55,398 | 55,720 | (322) | |

| Reserves for liabilities and expenses | 3,822 | 3,920 | (98) | |

| Losses from fixed assets | 205 | 4,109 | (3,904) | |

| Other | 25 | (25) | ||

| Minus | 12,932 | 13,578 | (646) | |

| Profits accruing from fixed assets | - | 576 | (576) | |

| Valuation adjustments for impairment of non-current assets | 189 | 190 | (1) | |

| Surplus provisions for liabilities and expenses | 120 | - | 120 | |

| Capital grants and others transferred to profit | 6,744 | 6,900 | (156) | |

| Income from return of concessions | 1,134 | 1,608 | (474) | |

| Entering advances received for services rendered in results | 4,745 | 4,304 | 441 | |

| Total | 104,092 | 93,861 | 10,231 | 11% |

Investment

Investment Borrowing

Borrowing

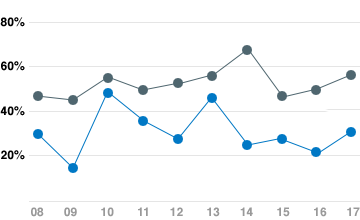

Bank debt / Equity

Bank debt / Equity

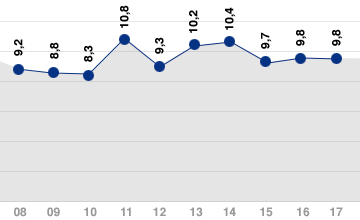

Cash flow / Turnover

Cash flow / Turnover